Get Email Updates • Email this Topic • Print this Page

That's what I just said in my post.

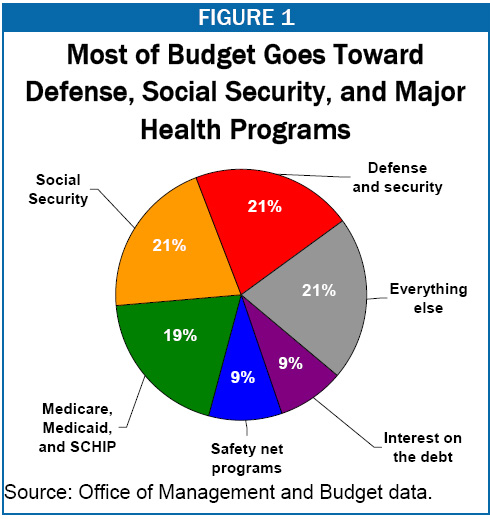

We spend more on social security than we do on the military and "defense spending."

Pork barrel spending is a huge percentage of our budget. Non-defense discretionary spending (most of which is pork barrel) accounts for around 15% of total spending.

Medicaid and Medicare cost more than military spending.

There is some truth in this statement, due to our quotas and tariffs and the fact that our trade agreements aren't actually free trade agreements as much as they are mercantilist ones supporting big corporations. Our trade agreements (like NAFTA) are, however, better than having no trade agreements whatsoever.

Depends on which year you pick out. However, over the past 50 years, we have spent far more on military and defense than on social security.

Also, Social Security takes in more revenue than it pays out.

We've spent over 270 billion on pork since 1991 - that's less than one years military spending.

I'd like to see some figures, because everything I've looked at shows otherwise - just under 400 billion for Medicare, well over 700 billion for defense.

Sure, having terrible trade agreements is better than having none, but no nation goes without trade agreements. Even free markets require trade agreements between nations.

Over the past 50 years we've been in the cold war. Picking the figures as you have done is unfair.

Your point?

You're right that military spending far outweighs pork barrel spending, but pork barrel spending is still a major source for hurt on the taxpayer (and businesses).

Free markets would actually require an absence of government intervention, meaning no trade agreements but an elimination of tariffs, quotas, etc. If other nations choose not to reap the benefits of trade, too bad for them.

Oh, I see what you're saying. Yes, you are correct in saying that military spending is a major source of our debt (especially when you consider the Cold War).

I would, however, have to say that Medicare, Medicaid, and social security are all major drains on our economy right now, in addition to military spending.

In any case, I don't think I ever contended that we can have free trade with nations that practice protectionist policies, that is simply counterintuitive.

What I did say was that we should eliminate tariffs, quotas, and other trade regulations with other nations. As Bastiat explained, protectionist policies only harm the nation that practice them. It makes no sense to demand higher priced, lower quality goods if we could get them for cheaper with a better quality from abroad.

In short, let's cut trade regulation and lead other nations by example.

Sure, these programs might be called "drains" on our economy, but I'm not convinced it's the programs themselves. The programs are far from perfect, lot's of inexcusable waste, but the real problem, I think, is the cost of health care in the US.

But you do advocate cutting regulations and leading by example in removing regulations.

The problem is actually putting this into practice. Let's say we can get the cheaper, better quality goods from abroad. In doing so, we risk the livelihood of those in this nation who produce similar goods.

If people lose their income, they can't very well take advantage of the hypothetical cheaper, higher quality foreign goods.

Thirty percent of which is due to regulation...

If you allow a flexible, open, free market to exist, this really wouldn't be as big of a problem.

Involuntary unemployment (frictional unemployment aside) cannot exist for long in a free market economy. Taxes, regulations, expansionary credit policy, and government/union imposed wage rigidities are at the source of involuntary unemployment, and doing away with these measures would promote entrepreneurs creating and expanding their businesses.

Comparative advantage is a great thing, you only have to allow the market to work.

In the case of health care today in the US, some degree of de-regulation might very well be helpful. Of course, this depends on how we go about things. Regulation and de-regulation - these are things which are sometimes and in some cases good, other times, bad.

But how is this supposed to work if the cheaper, higher quality goods come from protectionist nations?

That's the problem - unless we have some perfect world in which all nations have an absolute free trade policy we cannot demand that the solution to current economic woes amounts to pretending that said dream world does exist. In the meantime we have to pragmatic.

Sometimes de-regulation will be the answer, other times, regulation will be necessary.

In a perfect world, the de-regulation of airlines might have worked. In a perfect world, the de-regulation of the lending market that helped fuel the current bust might have instead brought about positive results.

How are entry fees, taxes, monopolies, etc. beneficial to consumers?

What do you mean?

We get cheaper, higher quality goods while they don't. It's beneficial to us, not them.

If you're arguing from the "job perspective," there are more than only two nations in the world, and even if there were only two nations, there's this little thing called comparative advantage.

When have we ever had true deregulation of airlines or the lending market? The current depression has been fueled by extravagant inflation of the money supply that has sent false signals to businesses about the spending/consumption rate of consumers.

As for deregulation of the lending market - are you being serious? I don't see how our current fascistic banking and lending industry resembles capitalism at all.

They are not always beneficial to consumers. And my interest does not end with consumers. Regulation should be a pragmatic tool to benefit or protect both consumers and workers and those who do not have the means to consume nor the ability to work.

Cheaper, higher quality goods from other nations is good from the perspective of the consumer. But this is often harmful to the worker in that they lose their job.

There are many nations in the world. Comparative advantage is nonfalsifiable - it's nothing more than wishful thinking, and sometimes the girl gets her pony. But this does not save jobs lost to overseas workers who produce cheaper goods.

In today's world, quality has little to do with the equation. Cheap is the bottom line, and many Americans have lost jobs because foreign firms can come up with cheap products, even if they are not as well made.

There has never been true deregulation of anything - that's the idealistic fantasy of free marketeers. My point is that regulation is sometimes helpful.

It does not resemble your ideal vision of capitalism. Not supposed to. It was just another example of de-regulation failing because of reality.

And that's my point - de-regulation and regulation are not to be used to pursue some ideal, they should be used pragmatically. Chasing ideals is not helpful when we have lives on the line. Sometimes de-regulation is the answers, other times, a disaster.

So government regulators know better than you and I and should be able to determine which regulations are bad and which ones are good?

Doesn't your proposal require a utopia where government actually can be trusted?

Also, wouldn't the interests of consumers and workers be protected by competition, unions, and consumer organizations in a free market?

You're ignoring comparative advantage. It seems that in your economic world viewpoint, all the jobs of one nation could move to another simultaneously, leaving an entire nation unemployed.

I remember reading that something like 90% of all economists want to completely remove tariffs, quotas, trade embargoes, etc. This isn't a very controversial idea.

Lastly, workers are consumers.

Well, first of all, eliminating our harmful regulations and taxes would bring businesses to us in floods.

Second of all, comparative advantage is very well established among all economists. Comparative advantage is economic law. It is not profitable or in the self interest of anyone to leave people unemployed. Involuntary employment mainly due to government intervention, not free trade.

Hondas and Toyotas are of inferior quality, obviously.

Right, as if that's a logical argument.

"That won't happen, so let's ignore that argument, it's supported by some ridiculous idealists, I'll say something is helpful without any evidence or examples, and let's ignore the fact that an ideal, perfect government is needed to support what I'm saying."

"My ideal of capitalism?" Again, is this a joke, or do you not understand free market fundamentals?

You can't say that deregulation fails when there are thousands of other factors, like huge taxes, entry fees, government-enforced monopolies and oligopolies, and a huge [government] monetary expansion driving businesses to make erroneous assumptions about consumer spending/saving habits.

And you have yet to provide an example of helpful regulation.

Depends on who those regulators are, hmm?

No, my proposal is that economic policy should be pragmatic. If we cannot trust the government to be pragmatic about economic policy we also cannot trust that government to use your free market principles. Personally, I don't trust the government to do either.

That's the idea, as I follow it. But the question is how well will consumers and workers be protected. Chasing ideals does not put food on the table.

And you're expecting comparative advantage to be an economic cure all. As for my economic world viewpoint - I've made no such claim. My view point is that we should be pragmatic, however radical I might be.

And your point is? I want to do exactly the same.

Not if the worker loses his job because it was outsourced to a nation without labor laws.

Sure, if the taxes and regulations are harmful, it would be best to remove them. The problem is that not all taxes and regulations are always harmful.

I trust you are just as capable as I am at looking up the criticisms of comparative advantage. Doing so might be useful at some point.

Comparative advantage does not work when capital is internationally mobile.

Because Honda and Toyota are the only foreign products we Americans consume, right. Have you ever been to Wal-Mart?

Talk about ignoring arguments - my point was that regulation is sometimes helpful. Would you like examples other than the recent airlines and lending markets? Medicine.

What you say about inflation is true, and this was no help. But the heart of the matter was deregulation of the industry, allowing banks to write loans to people who could not pay, and then sell those loans as investments.

Do you want to address the issues, or ask me if I'm a fool? Yes, your ideal of capitalism. Reality has shown that capitalism, like communism, is open to abuse by those in power. I give you the US as an example.

The terrible banking and lending industry is indefensible. However, deregulating that industry was definitely a poor idea. Again, deregulation can be harmful.

Good - because I didn't say deregulation fails. Instead, I suggested that we regulate and deregulate according to the circumstances before us, that we use pragmatic economic policy instead of idealistic laissez-faire capitalism.

Oh, I have, you just didn't like them. Airlines, lending. Remember? In this post I also give medicine as an example. If you want specific legislation, the Pure Food and Drug Act.

Wait... people exist who can calculate the subjective values of goods and services better than the market?

I'm pretty sure "free market principles" implies as little government as possible (or even no government).

So again, you're assuming that the government is ideal and can quantify values better than the billions of subjective values that form the market?

Is your definition of "pragmatic" equivalent with "unemployment," "inflation," and "tyranny?"

I can't see how you can ignore comparative advantage but still be anti-tariff.

Let me break this down for you:

So you're assuming that the income tax doesn't reduce aggregate demand, the payroll tax doesn't reduce wages and salaries, the property tax doesn't cause urban sprawl, the sales tax doesn't create improper price allocations, and tariffs don't prevent market inefficiency, correct?

Mobility of capital is irrelevant.

Are you saying that there is something morally wrong with buying cheaper products if they're from abroad? Are you xenophobic or racist by any chance?

(That is a rhetorical question, obviously.)

As for medicine, I'm assuming your mentioning the rising price of health care in general and medicine in particular.

No, that is not at the heart of the matter. What is at the heart of the matter is constant government catering of banks. If banks mismanage their assets, they will go out of business. This creates a strong incentive to make low-risk investments and to loan money to people who can afford to pay them back.

Because incredible monetary expansion, high taxes and tariffs, and a lot of red tape are an example of capitalism, right?

The root of the failure of banks and lenders is the government, as explained above.

Just that you have failed to provide ONE example of deregulation failing on its own accord.

As far as the Pure Food and Drug Act, you do realize that it is often used to outlaw products that people want, correct? For example, it was used to outlaw a drink produced by Coca Cola because it contained too much caffeine (even though people might have a demand for that caffeine).

Also, it does nothing that the free market wouldn't do. Businesses that label their products accurately are more likely to get more of their products sold. It could also be feasible for consumer interest groups to provide information about what is inside of foods.

The Pure Food and Drug Act is simply a waste of taxpayer money that could have been used in other ways with greater efficiency.

What are your thoughts or opinions?

How much more can we expect?

What are we, or can we do about this change?

:eek:

I think that the whole problem is that the government needs to lighten the bureaucracy, pay the senators less money, place some morality in the courts, deviate from petty conflicts, get out of middle east, spend more on research than of ways to target the false need for oil, less time in the political elections, create a cap for limiting money that a CEO can have in his/her life, stop the greedy globalization, think twice before voting in a republican (history teacher says they tend to leave the US in debt rather than surplus), stop taking the side of the the companies (in relation to health care), and just forget about Iran, just completely abolish that concept.:mad:

Better than the ideal laissez-faire market? Probably not. Better than the market we face in reality? Yes. Gas prices, for example.

Yes, free market principles implies small government, maybe even no government. You asked if my proposal required some utopian, trustworthy government. The answer is no. I do not expect any government to be trustwrothy, trust worthy enough to make pragmatic economic decisions of trustworthy enough to apply free makret principles without abusing the public (Reagan and Bush II, for example).

As I said, I do not trust the government to do either. My proposal is that government should institute pragmatic economic policy. Often this policy would mirror your suggested free makret policy, the difference is that I would not tie economic policy to free marketeering as doing so would not properly take into account the reality of our tumultuous economic environment.

No.

Cute, but no.

I'm not ignoring comparative advantage, I'm saying comparative advantage is an outdated economic theory that is quickly losing economic reliability in our increasingly global market.

Tariffs can be useful, but are often the result of special interests rather than pragmatic policy decisions. Generally, I think tariffs are more destrcutive than helpful, but again, I'm not concerned with ideals, I'm concerned with what works.

Look, I get comparative advantage. The problem is that comparative advantage is not as useful as it once was because the economy is increasingly global.

No. Stop putting words in my mouth. Taxes and regulations can do as you say (or at least influence - property tax isn't the only factor in urban sprawl), but they do not necessarily do more harm than good.

Ricardo's arguments for comparative advantage is premised on the relative immobility of capital between nations. Hardly irrelevant.

Rhetocial question or not, you failed to make the point.

No, I was refering to the turn of the century regulation of medicine in the US. An example of government regulation that was helpful.

We can debate the other cases all day and night. I'm not interested in that. All I need is one example of helpful regulation. If we disagree on one of my examples, that's fine, we'll move on to the next. I'll wait to see if you disagree with my example of medicine.

Was the deregulation harmful? Yes. The deregulation was not pragmatic. Under different cirucmstances, the deregulation could have been helpful, maybe.

You're right about the government messing things up. But so what? We cannot go back in time to change policy, we have to move forward with policy. This means making pragmatic decisions, taking into account current circumstances.

I'm sorry, did you miss the turn of the century and Standard Oil?

Doesn't matter - deregulating the market was not a pragmatic decision. And I'm advocating pragmatic economic policy.

On it's own accord? You miss the point. Again, we cannot go back in time to change economic policy, we have to move forward. Moving forward means taking into consideration current conditions. Under some conditions, deregulation is harmful. One example is the recent deregulation of the housing market.

Another is the deregulation of the airlines.

So what? I'm not saying the legislation was perfect. The point was that the legislation was an example of regulation being a good thing. And the Pure Food and Drug Act was obviously a great imporvement.

Depends on the conditions. At the time, products which were not properly labeled sold quite well.

Then you can go buy a bottle of whiskey next time you get a cough instead of something that will actually help your cough.